As we approach the month of August 2025, it’s essential to stay on top of your tax obligations to avoid any last-minute stress. Keeping track of important tax deadlines can help you plan ahead and ensure everything is in order.

Whether you’re a business owner or an individual taxpayer, the August 2025 Tax Calendar is a valuable tool to help you navigate the upcoming deadlines. From filing quarterly estimated taxes to submitting payroll tax deposits, there are several key dates to keep in mind.

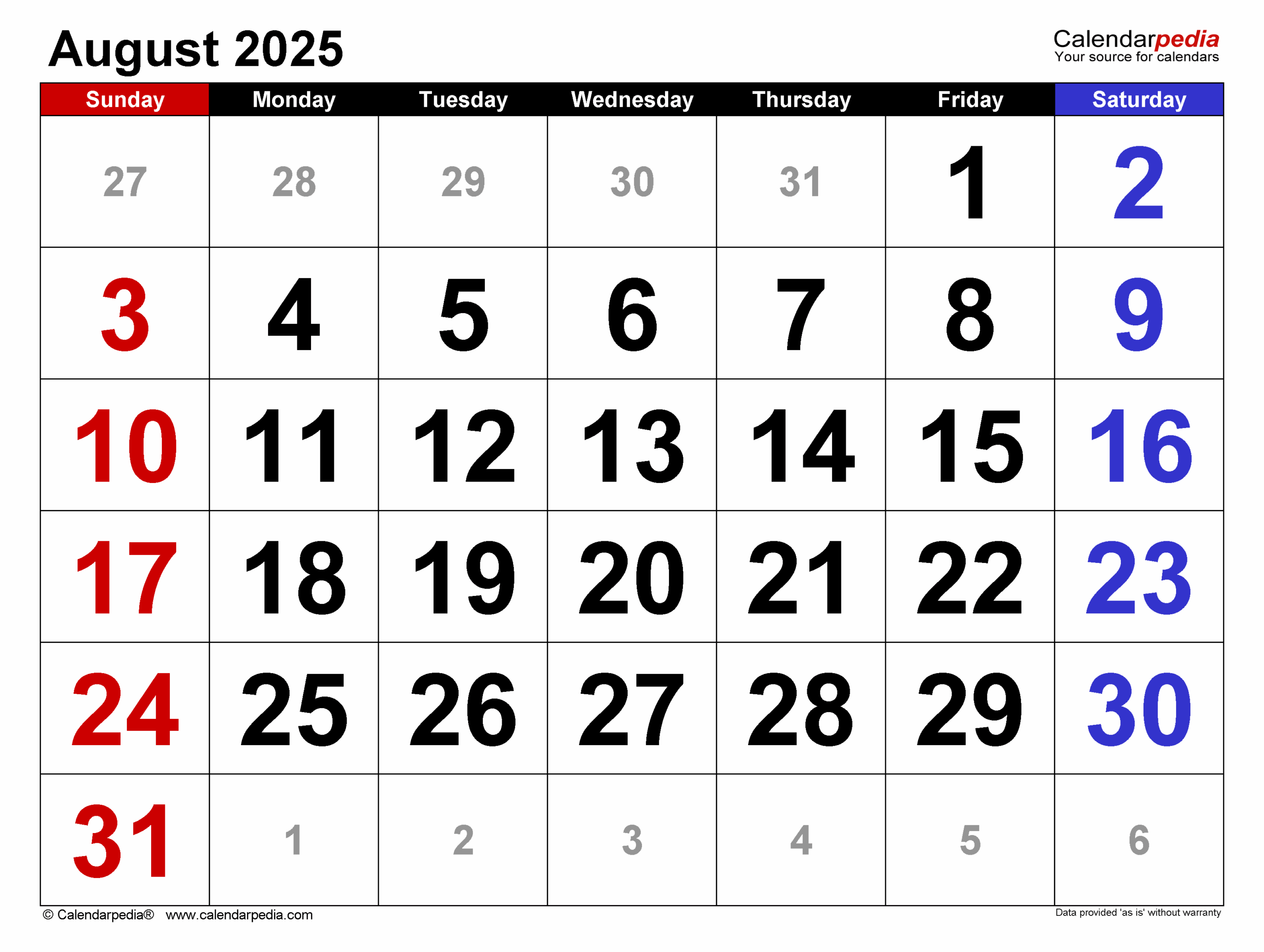

August 2025 Tax Calendar

August 2025 Tax Calendar

One important date to note is August 15th, which is the deadline for self-employed individuals and businesses to pay their second-quarter estimated taxes. It’s crucial to calculate and submit your estimated tax payments on time to avoid any penalties or interest charges.

Additionally, August 30th marks the deadline for employers to deposit payroll taxes for the month of July. Ensuring timely payroll tax deposits is essential to avoid any potential IRS issues and maintain compliance with tax regulations.

For individual taxpayers, August 31st is the last day to file Form 4868 for an extension on filing your federal tax return. If you need more time to prepare your taxes, submitting Form 4868 can give you an additional six months to file without facing late filing penalties.

Staying organized and informed about the upcoming tax deadlines in August 2025 can help you avoid unnecessary stress and potential financial consequences. By utilizing the August 2025 Tax Calendar, you can plan ahead and stay on track with your tax obligations.

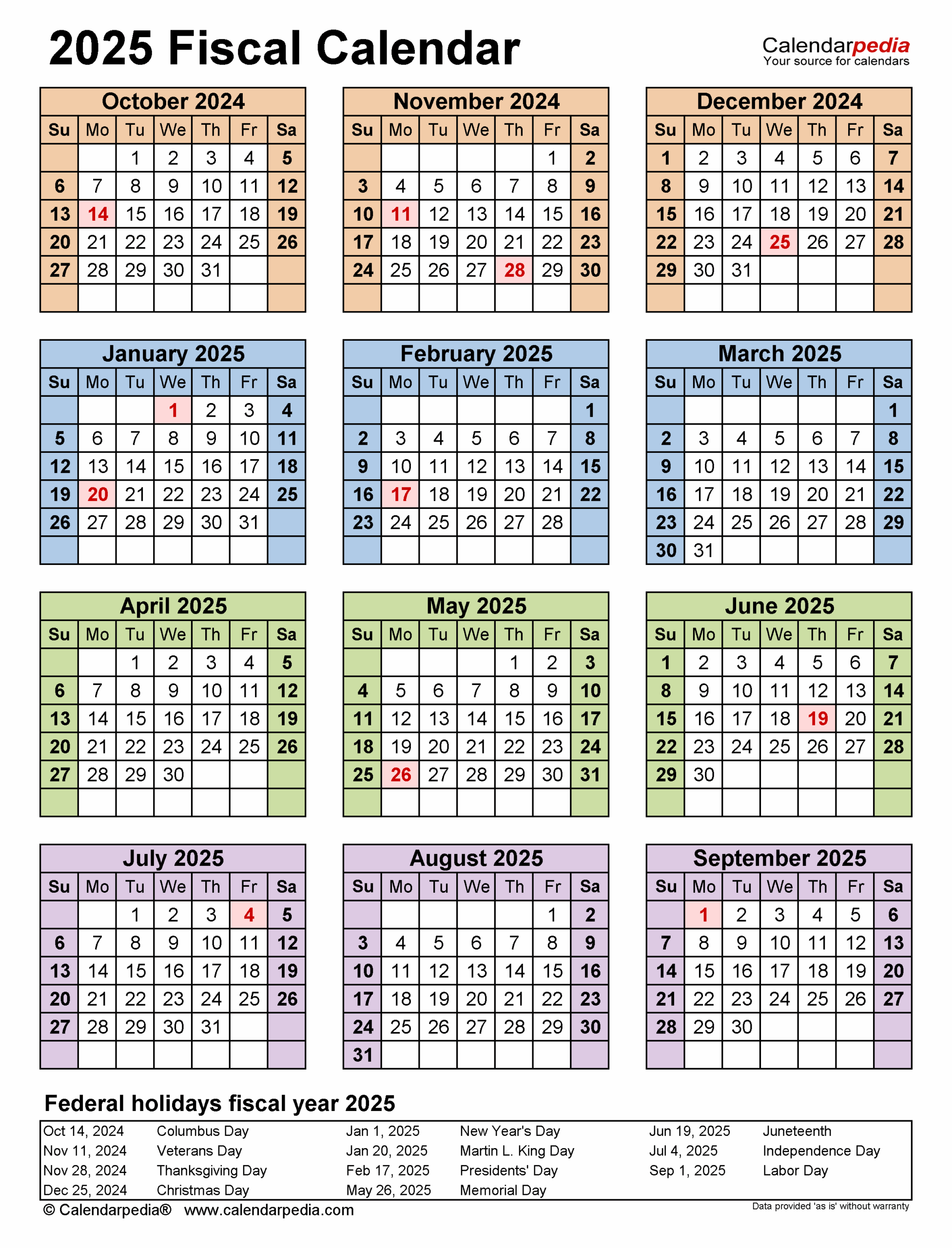

Fiscal Calendars 2025 Free Printable PDF Templates

August 2025 Calendar Templates For PDF Excel And Word

August 2025 Calendar Templates For PDF Excel And Word

Income Tax Calendar Important Dates For F Y 2024 2025

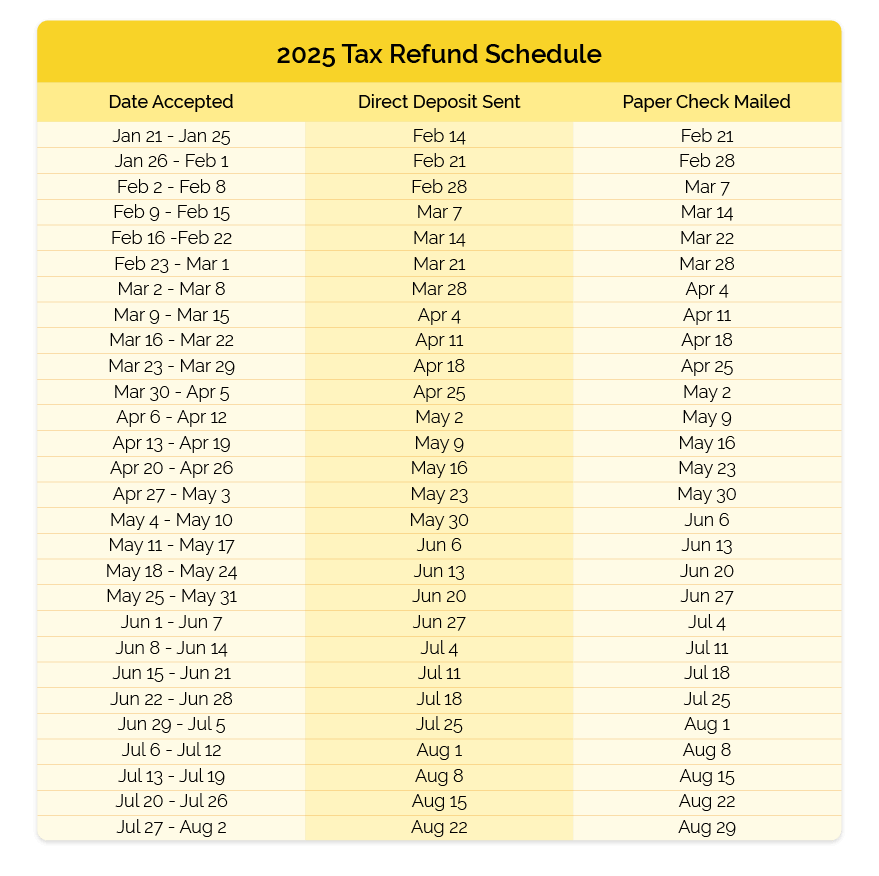

The 2025 IRS Tax Refund Schedule Where s My Refund